buzzfeed.com

- Gerar link

- X

- Outros aplicativos

GERMAN GOLD REPATRIATION

Why Germany Wants Its Gold Back

Tom Grill | Age Fotostock | Getty Images

"Germany looks to repatriate gold." There was a headlinethat stirred debate this morning.

Germany is repatriating some of its gold supply held in the U.S. and France and returning it to Germany. Is it a sign that the Bundesbank no longer trusts other central banks? That the Bundesbank is unhappy with the fiscal irresponsibility of Washington?

I doubt that. This has little to do with distrust among central banks. Germany put gold in the U.S. during the cold war because of fear of the Soviet invasion. That has long since gone away. It makes sense to bring some of it back.

But there's a more immediate reason why this is happening now: it has a lot to do with the euro crisis, and a little bit to do with the continuing value of gold and its convertibility into currency.

Some German politicians unhappy with German concessions on the euro have been complaining that the crisis is a threat to Germany's control of its foreign reserves. They want more control of those reserves, which would include the gold supply.

The Bundesbank explicitly stated this in their press release, saying it would give them "the ability to exchange gold for foreign currencies at gold trading centres abroad within a short space of time."

The Germans also say "the gold serves the purpose of being flexible in a crisis," according to Bundesbank board member Carl-Ludwig Thiele, who was quoted in the WSJ online this morning.

Germany has the second largest gold reserve in the world after the U.S. About 45 percent of the holdings are in New York, 31 percent are in Frankfurt, London has 13 percent, and Paris has 11 percent as of December 31, 2012.

They are looking to reduce the 45 percent holdings in New York to 37 percent, and Paris to zero. That would bring the German's gold supply to about 50 percent in Frankfurt.

That is hardly a wholesale rush home.

It's not even a rush: the Germans said they would accomplish the move "by 2020."

As a side issue, there have been calls to repatriate the gold and get a full audit of the gold supply.

Most central banks do not do regular physical audits of their gold supplies, and this has led to fairly regular calls in many countries--including the U.S.--for a full physical audit.

Most of the U.S. gold supply is held in Fort Knox. Some have argued that an audit is necessary to determine if any of the gold has been lent out, or if all of it is still physically present.

By the way: if the Germans do start exchanging gold for currency (like the U. S. dollar), that would be an issue. It would tell us the Germans are really worried about the euro.

Now THAT would be a story.

According to the World Gold Council, these are the largest government holders of gold (in tonnes):

- U.S.: 8,133

- Germany: 3,396

- IMF: 2,814

- Italy: 2,451

- France: 2,435

- China: 1,054

- font images google

- font redaction cnbc.com/id/100384749

GERMAN GOLD REPATRIATION CONTINUES AND THE FED’S VAULT EMPTIES

German Gold Repatriation.

German gold repatriation begun in 2013, continues.

Germany is the owner of the second largest central bank gold hoard, much of it held at the New York Federal Reserve.

The majority of Germany’s gold is held abroad. The Bundesbank plan is to repatriate gold in sufficient amounts to have at least half of their gold in Germany by 2020.

Germany and other countries repatriating their gold are emptying the New York Federal Reserve’s vault.

Update May 5, 2015: Another 10 tons of gold left the NY Fed vaults in March 2015. (see chart below)

Why Germany Has Much of its Gold Abroad

According to the World Gold Council Germany has 3,384.2 tons of gold, the second largest central bank gold holdings*.

Until recently, Germany stored 69% of its gold abroad in London, Paris and New York. By 2020 the German Bundesbank claims they will have half of their gold in Germany, 37% at the New York Federal Reserve and 13% in London at the Bank of England.

Jens Weidman, President of the Deutsche Bundesbank explains in this video from the Deutsche Bundesbank the historic reasons (Cold War concerns) for storing Germany’s gold abroad and the changed circumstances. He notes there is no need to have gold in France since Germany and France share the same currency, the Euro. London and New York provide geographic diversity and dollar and pound exchange capabilities.

Germany Requests Its Gold Back – A Slow Start

In January 2013, Germany made a gold repatriation request to United States Federal Reserve in New York and Banque de France in Paris regarding a portion of the gold they held on deposit at those entities. At the time, Germany cited the potential of a currency crisis and the need to have its gold close by.

Germany requested repatriation of a total of 674 tons of gold from the New York Fed and the Banque de France. The Fed notified Germany their gold would be delivered over a period of eight years, raising eyebrows as to why it would take so long to make the requested repatriation.

In January 2014, it was reported that just 37 tons of gold had been returned to Germany, with 32 tons coming from Paris and just five tons from New York.

The Pace Picks Up

In January 2015, however, the German central bank the Bundesbank announced that it had received 120 tons of gold in 2014; 35 tons from Paris and 85 tons from New York.

In March of 2015, Henner Asche, deputy head of markets for the Bundesbank noted that 67 tons of gold had been transferred from Paris to Frankfurt and 90 tons from New York to Frankfort, reflecting an increase in the amounts reported at year end 2014 and bringing the total received to 157 tons.

Herr Asche also reported that 1,447 tons of the Bundesbank’s gold were held in New York, 438 tons in London and 307 tons in Paris.

Germany Kicks off a Repatriation Craze

Germany’s request in January 2013 to have its gold repatriated set off a slew of interest in gold repatriation from other central banks including those in the Netherlands, Belgium and Austria. Gold repatriation requests have continued to drain the New York Federal Reserve’s gold vault.

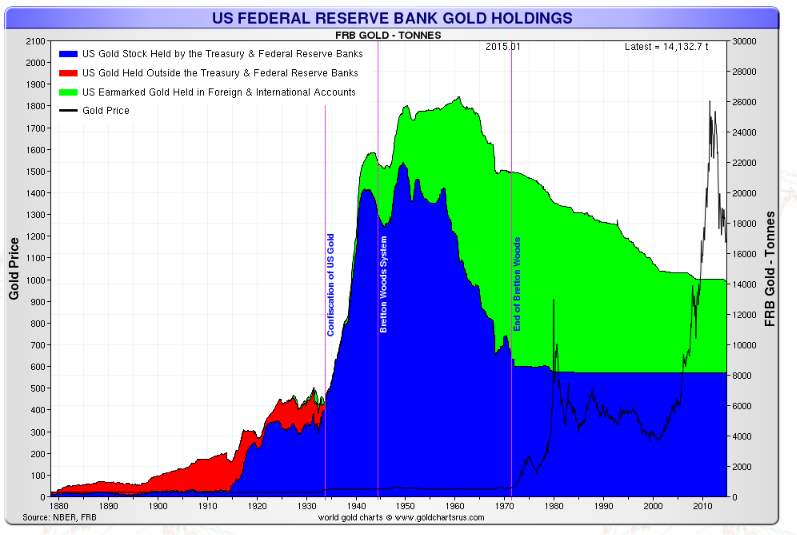

U.S. Federal Reserve Gold Holdings

The charts below (click to enlarge) by Nick Laird of Sharelynx show the most current Federal Reserve gold holdings.

In January 2015 19.891 tons of gold left the NY Fed and another 9.5571 tons were shipped out the door in February.

U.S. Federal Reserve Gold Held on Behalf of Other Nations

In March 2015, the NY Fed shipped out more than ten tons of gold.

Another ten tons of gold left the NY Fed in March. Nearly 200 tons of gold have been removed over the past twleve months.

*For a list of the top twenty gold holding nations and commentary click here.

smaulgld.com/german-gold-repatriation

font redaction

- Gerar link

- X

- Outros aplicativos

Comentários

Postar um comentário